Discover Your Personal Money Legend

Financial Wellness for ADHD Minds

We know that managing money with ADHD goes beyond budgets and spreadsheets. It's about building a relationship with money that works for your unique way of thinking. Turn financial overwhelm into confidence and success—one intentional step at a time.

ADHD and Debt

Adults with ADHD are more likely to carry high personal debt and rely on costly options like payday loans.

High-Interest Loans

Adults with ADHD are more likely to use high-interest borrowing options like payday or pawnshop loans.

Lower Net Worth

By retirement, adults with ADHD have an average net worth 25% lower than neurotypical peers, partly due to earning 30% less annually.

Missed bill payments and forgotten returns often add up to unnecessary costs, commonly referred to as the "ADHD tax."

Impulsive Spending

ADHD often leads to impulsive purchases, driven by challenges with emotional regulation and self-control.

Struggles with Financial Decisions

ADHD can make financial decision-making harder, including identifying key info, delaying gratification, and planning for the future.

Financial Confidence Gap

Negative experiences like repossessions or missed payments can lower financial self-confidence for adults with ADHD.

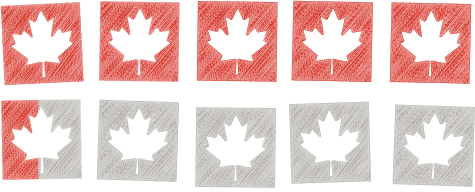

54% of Canadians live paycheck to paycheck

For those with ADHD, financial challenges can feel even more overwhelming. But here's the truth: your ADHD mind isn't broken - it just needs the right tools and support to thrive.

Take Your First Step Toward Financial Empowerment

A Behavioral Approach

We go beyond budgeting to address the emotions, habits, and patterns that impact your relationship with money—turning insights into lasting change.

Expert-Led Courses

Our program is designed by experts in behavioural therapy and financial wellbeing, ensuring you get practical, evidence-based strategies tailored to ADHD minds.

Coming Soon: AI Support

Our AI-powered tools are in development to make your journey even smoother. From personalized recommendations to 24/7 support, advanced AI functionality is on its way.

Tools designed for you

Challenges

Engage in fun, interactive tasks to build better financial habits step by step.

Your advice counts too

Share tips, tricks, and strategies with fellow users to create a supportive community of real-world insights.

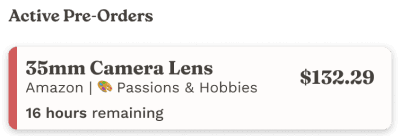

Preorder

Visualize how purchases impact your budget before you commit.

Early Access Benefits

Be the first to experience The Alchemist's innovative tools.

Shape the future of the platform by providing feedback.

Gain early access to resources designed to transform your relationship with money.